2026 Proposed Business Plan & Budget

Working Together for Elgin County

Elgin County is an Upper-Tier Municipality serving approximately 52,000 residents across seven unique Municipalities:

- Municipality of West Elgin

- Municipality of Dutton Dunwich

- Township of Southwold

- Municipality of Central Elgin

- Town of Aylmer

- Township of Malahide

- Municipality of Bayham

Together, these Municipalities collaborate with Elgin County to offer the following services that support our vibrant communities, businesses, and visitors.

Elgin County consists of 12 service areas dedicated to exceptional programming for you, our taxpayers. Each department addresses specific needs and ensures efficient County operations. Elgin County Council sets policies and priorities, while the senior leaders and staff carry them out by managing budgets and overseeing daily operations. Together, County Council and staff prioritize transparency, accountability, and innovation to foster a welcoming environment for you, the taxpayer.

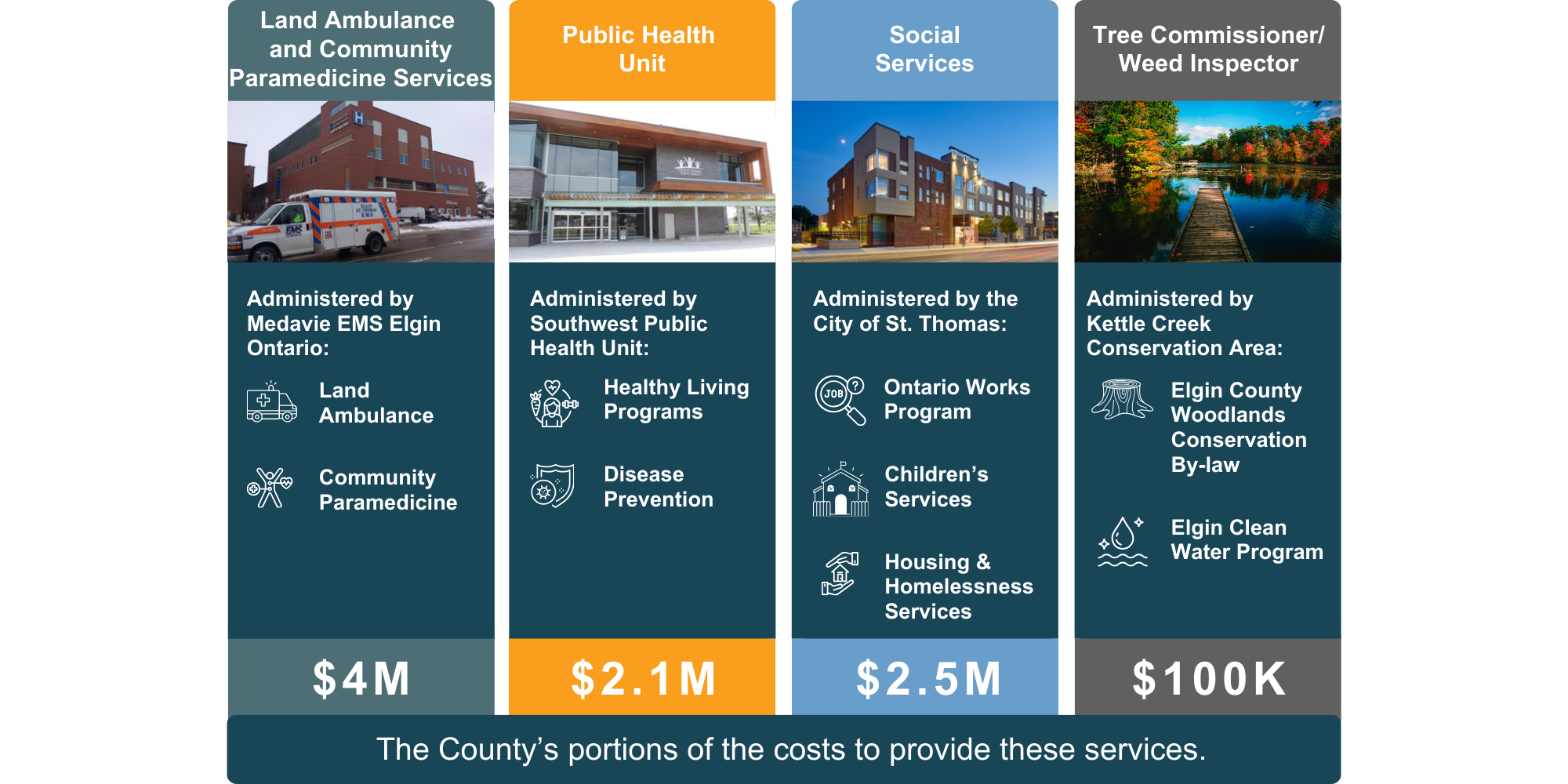

The following service areas are funded by the County but are delivered by other organizations. These collaborations ensure that specialized expertise is utilized to address community needs effectively. By working with dedicated partners, the County is able to offer comprehensive support across various sectors, enhancing the quality of life for all residents. This approach not only maximizes resource efficiency but also fosters a spirit of cooperation and shared responsibility among local agencies and organizations.

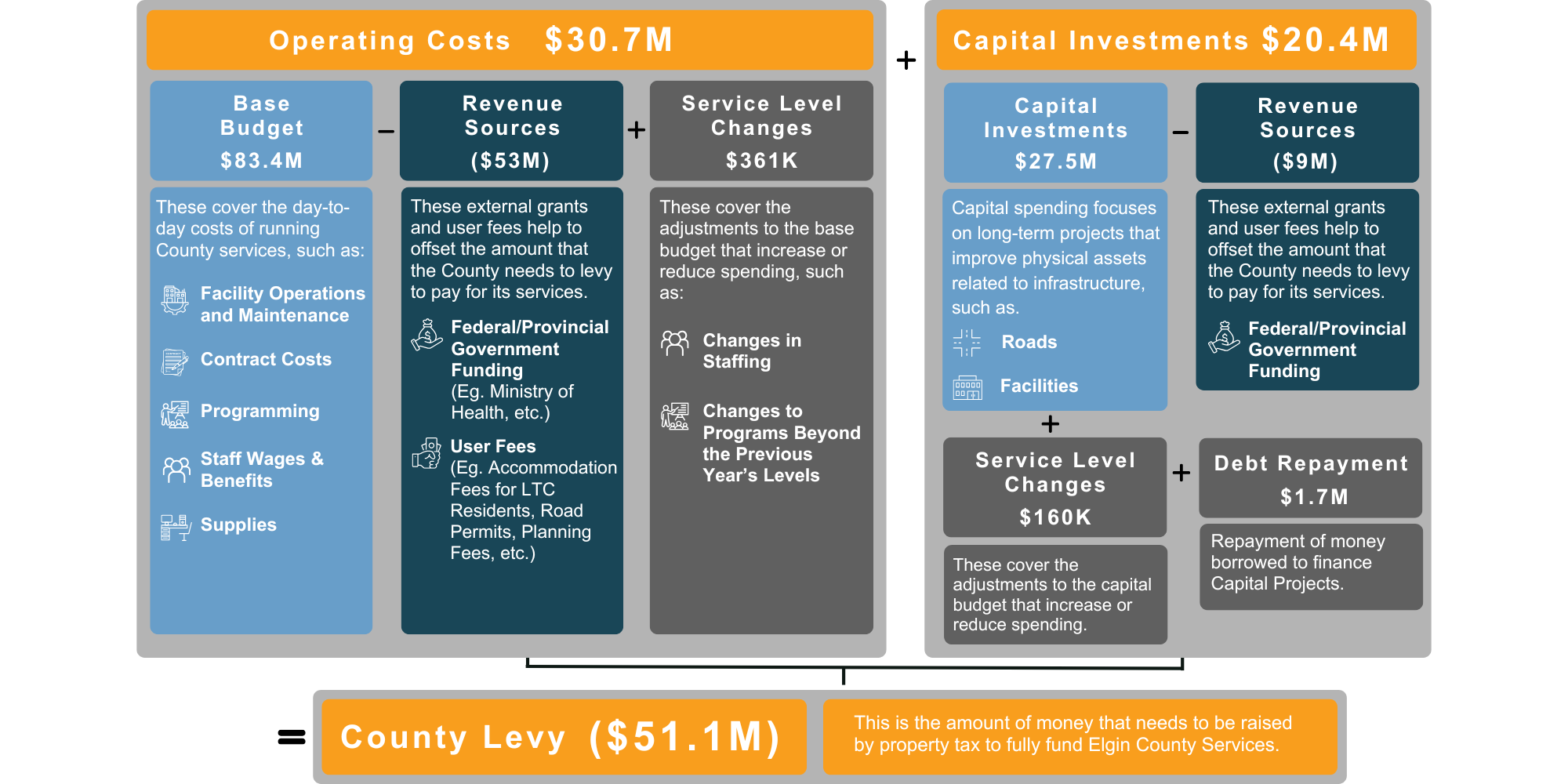

How the Budget Works

The County’s budget shows how your tax dollars and other revenues are used to run programs, maintain infrastructure, and invest in projects. It includes:

- Operating Costs: These include both the base operating budget and any service level changes. The base budget covers the day-to-day costs of running County services such as facility operations, programming, staff wages, supplies, and contracted services like EMS and Social Services. Service level changes are adjustments to the base budget that increase or reduce spending, such as hiring new staff or adding programs beyond the previous year’s levels.

- Capital Investments: Long-term projects that improve infrastructure, replace equipment, and extend the life of County assets, as well as some service level changes.

- Revenue Sources: Funding comes from the County tax levy, provincial and federal grants, user fees, and other revenues.

Budgets can often be complicated. To simplify the process, below we have detailed how the Elgin County budget is created:

How the Budget is Funded

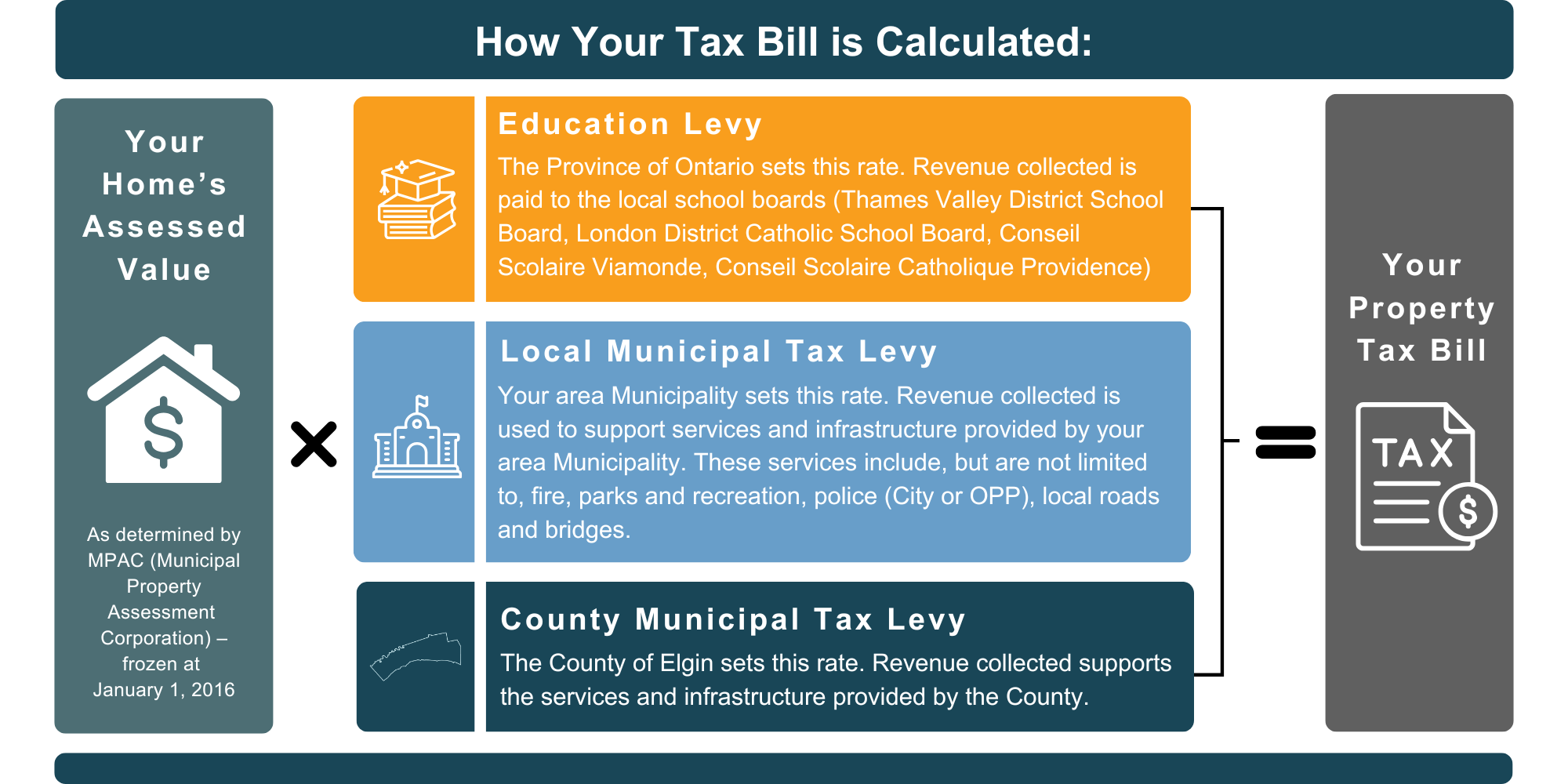

Your property taxes help pay for County services. Both your local municipality and the County collect taxes to fund the services each provides. The County levy is collected by local municipalities through a single property tax bill and then transferred to the County. The same bill also includes education taxes, which go to local school boards. The County also receives provincial and federal grants and user fees to help offset the cost of municipal programs and services.

The figure below illustrates how your home or property’s assessed value is used to calculate your property tax bill:

How the Budget is Created

The budget is developed in several steps over a few months:

- Department Planning: Each department reviews needs and projects for the year ahead.

- Finance Committee Review: County Councillors review department budgets, operating costs, service level changes, and capital projects.

- Public Consultation: Residents and businesses can provide feedback through an online survey or by attending the public consultation meeting.

- Council Approval: County Council approves the final budget, which guides operations for the year.

See the 2026 Budget Process Timeline for all key dates.

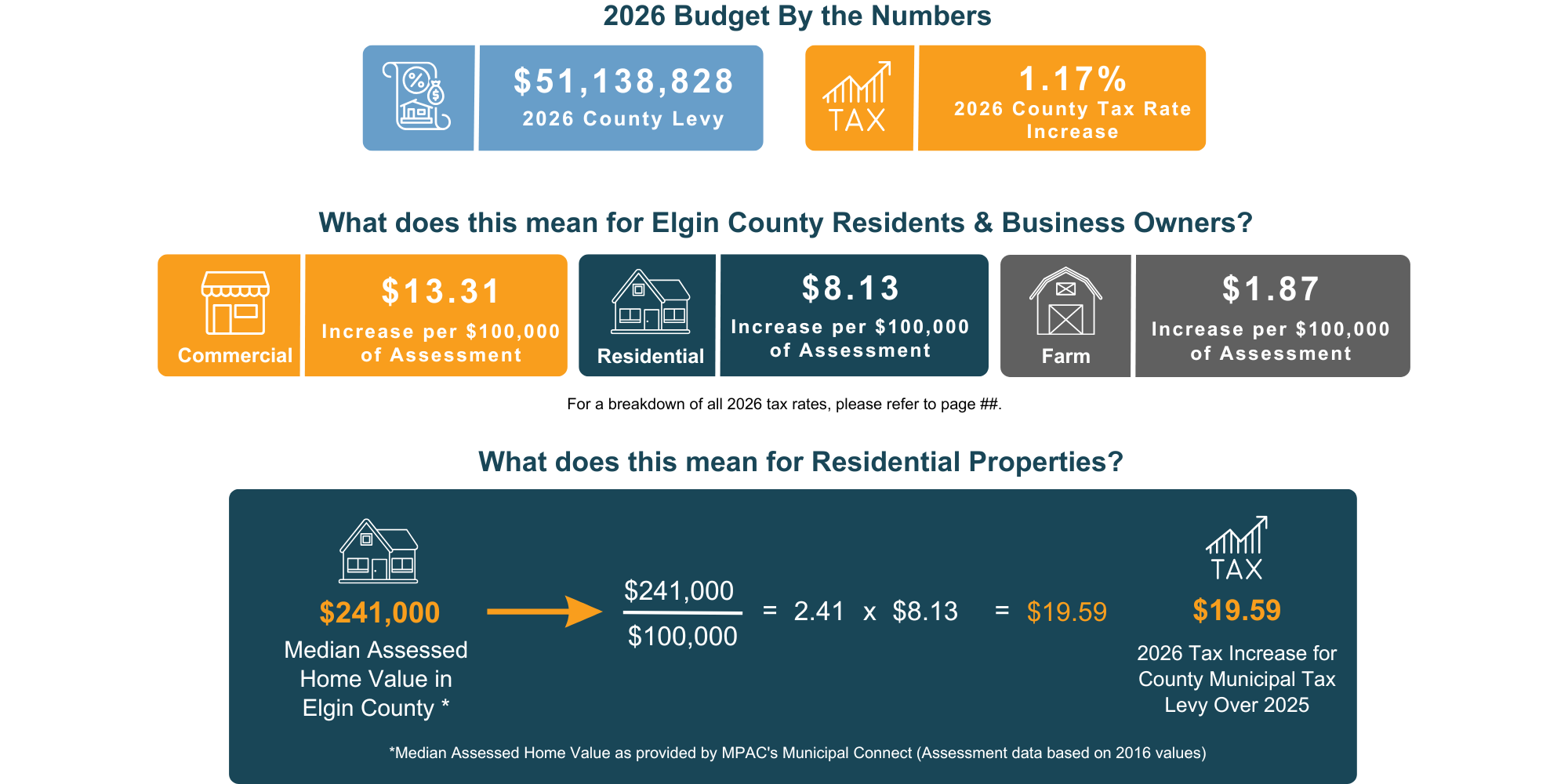

What Does This Mean For You?

For 2026 Elgin County Council is proposing an annual County Levy of $51.1M. This is an increase of $1.3M over the prior 2025 County Levy of $49.8M. This equates to a 1.17% increase in tax rate on an average property.

How You Can Participate

Read the 2026 Proposed Business Plan & Budget, found here.

Your input matters. You can become involved through any of the following options:

- Complete the Budget Survey below (available Dec 4 – Dec 11)

- Attend or watch Finance Committee and Council meetings

- Join the Public Consultation Meeting to share feedback directly with Council (Elgin County Administration Building - 450 Sunset Drive St. Thomas - Council Chambers - December 16th 5:30pm - 7pm, email: adminteam@elgin.ca to register as a delegate)

What Happens After Approval

Once approved, departments begin implementing funded programs and projects. County staff track progress throughout the year to ensure your tax dollars are used responsibly.